Max Life Group Offers Four different NPS Solutions to meet your retirement Financial Needs

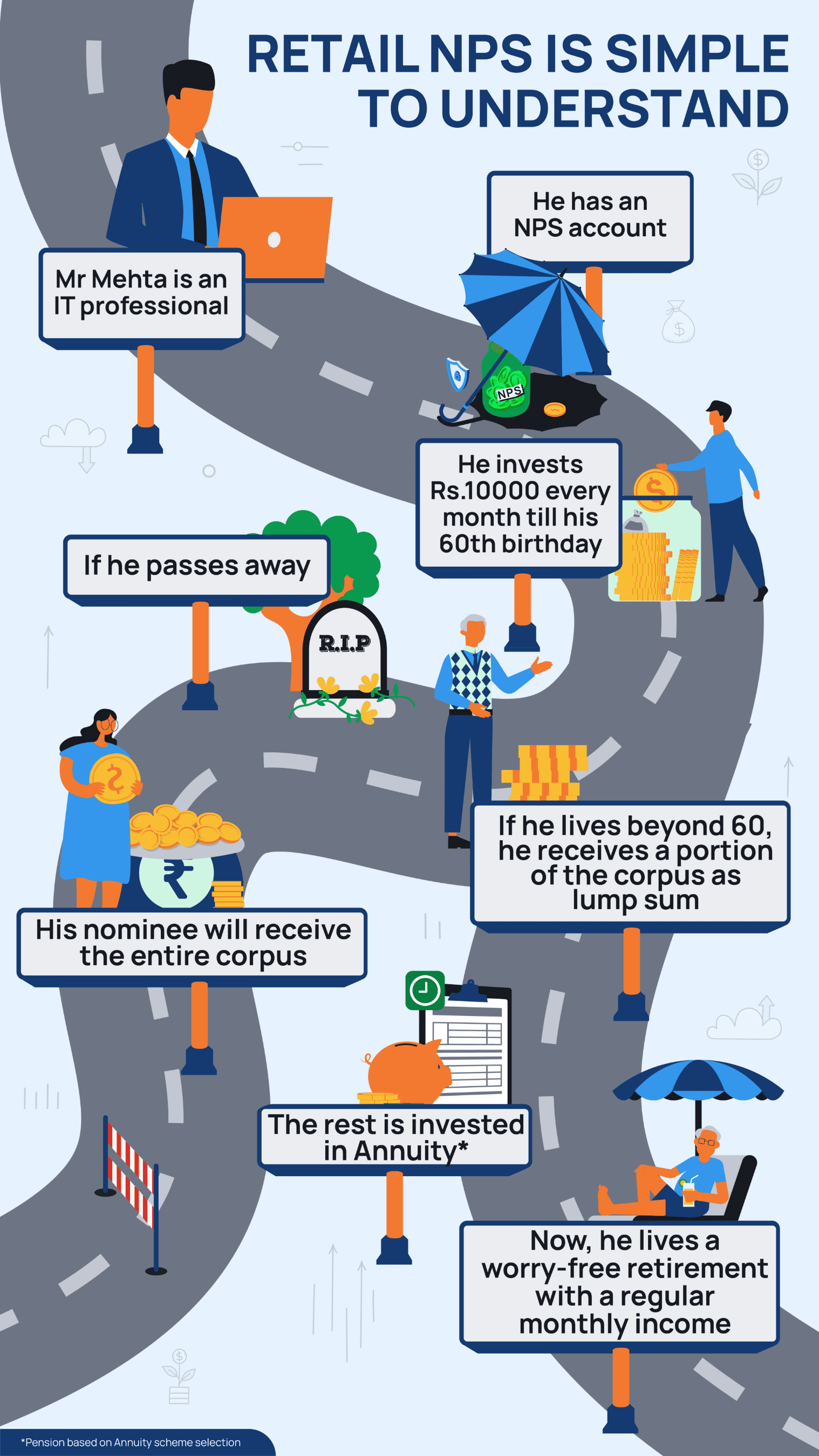

Let's Understand Retail NPS in detail

Who can Join?

All the citizens of India, including OCIs (Overseas Citizens of India) and NRIs

The subscribers, must be between the age of 18 to 70 years at the time of registration

The subscribers, must successfully comply with the KYC requirements

Benefits of Retail NPS

It is extremely well-regulated, regulated by the PFRDA, created by the Act of Parliament

Retail NPS comes with a number of tax-related benefits based on the Income Tax Act

It is one of the most inexpensive pension scheme with low fund management and administrative fees

Tax Benefits

Section 80 CCD (1): Under this subsection, investments made into NPS Tier 1 account qualify for tax deduction of up to Rs. 1.5 lakh in a financial year as part of the overall tax saving limit u/s 80CCE of the Income Tax Act.

Section 80 CCD (1B): This subsection of the Income Tax Act, 1961 allows Retail NPS subscribers to claim an additional deduction of Rs. 50,000 in a financial year for investments made into the NPS Tier 1 account. This is over and above the Section 80 C limit of Rs. 1.5 lakh.

How does Retail NPS Work?